Fast International Payments in 2025: The Problem-Fix Guide

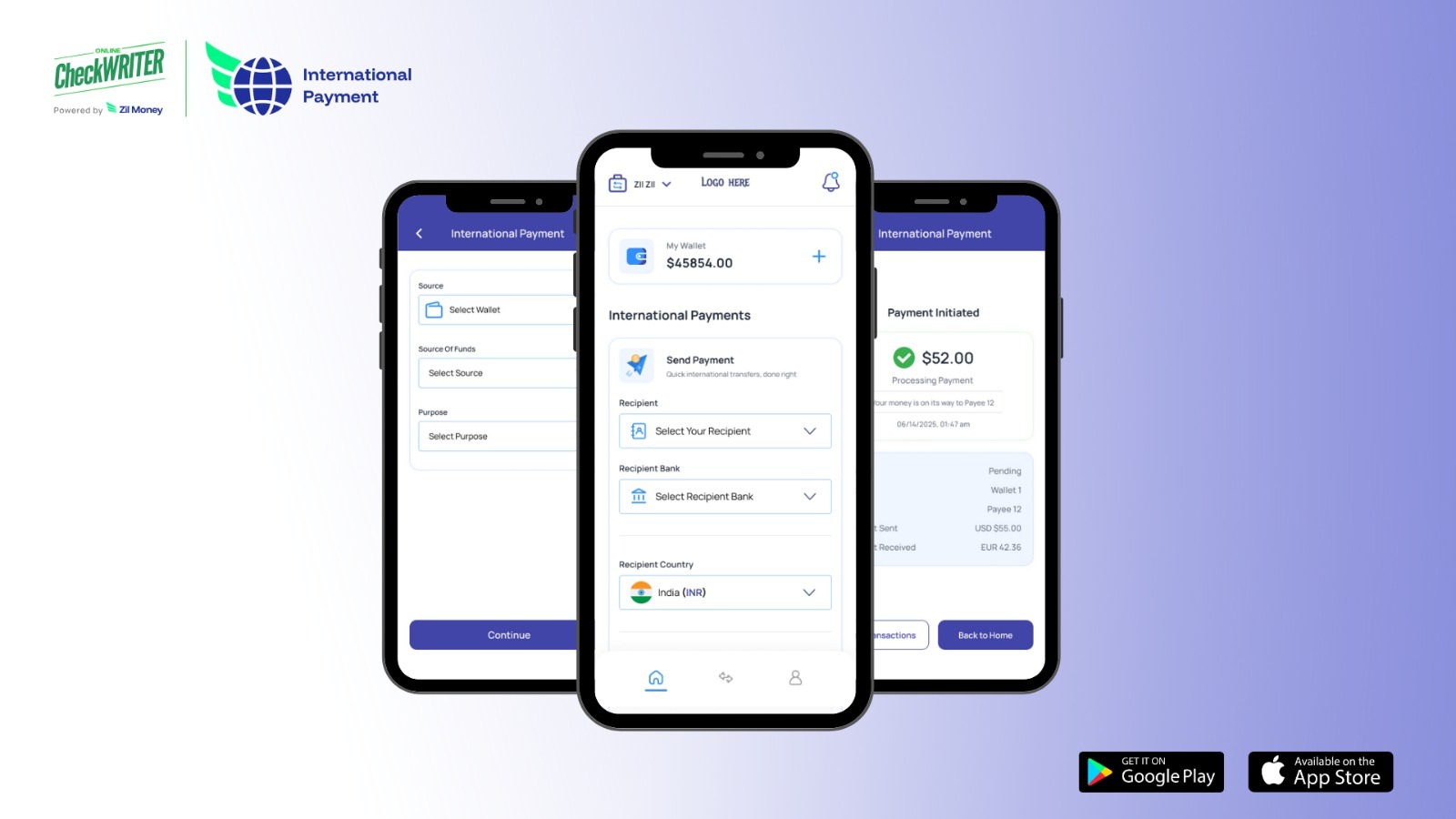

The New Mobile App from OnlineCheckWriter.com – Powered by Zil Money Turns Delays into Opportunities

In 2025, fast international payments are the lifeblood of global business. Yet many organizations still hit the same roadblocks: delayed transfers, surprise charges, frozen capital, compliance headaches, and security doubts.

The new mobile app from OnlineCheckWriter.com – Powered by Zil Money was built to turn those roadblocks into fast lanes. Let’s look at the common problems companies face with cross-border transactions—and the practical fixes this app delivers.

Problem 1: International Payments Take Too Long

When payments drag on for days, entire operations suffer. Traditional cross-border payments can take up to seven days to settle , halting production and creating cash flow challenges. A U.S. manufacturer depending on tool shipments from Germany often found production halted until payments cleared. Every delay meant wasted hours, stalled machines, and rising costs.

The Fix: With the new mobile app, transfers move in minutes instead of days. Suppliers receive funds quickly, raw materials keep flowing, and production lines never stop.

Problem 2: Surprise Fees Erode Margins

Hidden deductions have long been the cost of doing cross-border business. Intermediary bank fees can range from $15 to $30 per transaction, and some banks charge up to $45 for outgoing international transfers in U.S. dollars. A logistics provider paying carriers across Europe often found that unexpected charges had eaten away at profits.

The Fix: The app eliminates financial guesswork. Every payment comes with upfront, transparent pricing, so what you see is exactly what you pay. No hidden cuts, no partner disputes—just clarity that keeps margins healthy.

Problem 3: Capital Gets Locked Up in Pre-Funding

Many systems demand pre-funding before payments can move abroad. A consulting firm in New York investing in projects in Germany was forced to freeze working capital in advance, limiting flexibility. That meant less cash available for growth opportunities.

The Fix: The app removes the pre-funding requirement entirely. Businesses keep liquidity free while still sending payments abroad instantly. This flexibility helps companies react faster and fund new initiatives.

Problem 4: Compliance Slows Everything Down

Global compliance rules can feel like a maze. A SaaS startup with developers in Estonia and designers in U.K dreaded payroll week because every transfer seemed to trigger extra paperwork. With fintech adoption rates for insurance at 27% and growing , compliance drained hours of focus from a lean team.

The Fix: With this app, compliance guardrails run silently in the background. Transfers align with international standards automatically, freeing teams to concentrate on projects instead of red tape.

Problem 5: Concerns About Mobile Security

Many decision-makers hesitate to approve large payments via mobile. For a logistics coordinator handling six-figure freight invoices, the thought of processing payments on a phone once seemed risky. However, with over two billion people using mobile payments in 2023 and the market projected to reach $27.81 trillion by 2025, mobile is no longer just for small transactions.

The Fix: The app brings enterprise-grade safeguards into the palm of your hand. With encryption, fraud detection, and transaction tracking, mobile payments are secure for everything from small contractor invoices to major international deals.

Industry Examples: How the Fixes Add Up

- Manufacturing → Faster supplier payments keep assembly lines running without costly interruptions.

- Tech & Remote Work → Developers, designers, and contractors across continents are paid in minutes.

- Logistics → Carriers receive immediate payments, so shipments move on time.

- Services & Investments → Consulting firms and investors fund projects abroad without delays.

Across industries, the difference is clear: faster payments don’t just save time—they drive growth.

Why This Matters Now

Fast international payments are no longer about convenience. They are the currency of trust in global business. Companies that move money at today’s speed gain an edge—stronger supplier terms, happier teams, and smoother partnerships. Those that stick with outdated systems risk missed opportunities and frustrated partners.

The new mobile app from OnlineCheckWriter.com – Powered by Zil Money delivers that speed with transparency, flexibility, and security. It’s not just solving payment problems—it’s reshaping how global business gets done.

The next step!

Don’t let slow transfers or hidden fees stall your business.

Download the app today from the App Store or Google Play and put global payments in the palm of your hand.

FAQs

- How fast are international payments with the app?

Most transfers clear within minutes, keeping businesses aligned with global operations.

- Is the app secure for large-value transactions?

Yes. With encryption, fraud monitoring, and tracking, every payment is fully protected. - Do I need to pre-fund before sending money abroad?

No. The app eliminates pre-funding requirements, keeping capital available while enabling fast payouts.