IRS Form 1040 Explained: What It Is and How to File

When it comes to filing your taxes, IRS Form 1040 is the key document you’ll need. It’s essential for reporting your income and calculating your tax liability. But do you know if you’re required to file it? Understanding the nuances of this form can save you time and money. Let’s explore the details that could impact your tax situation significantly.

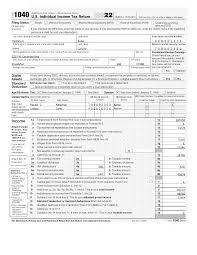

Overview of IRS Form 1040

When you need to file your individual income tax return, IRS Form 1040 is the primary document you’ll use.

The 1040 form is designed to report your annual income, calculate your tax liability, and claim any deductions or credits. It consists of several sections where you’ll detail your income sources, including wages, interest, and dividends. If you have additional income or adjustments, you’ll use Form 1040 Schedule 1 to report these. This supplemental form allows you to include items like student loan interest or educator expenses.

Completing the 1040 tax form accurately is crucial to ensure you meet your tax obligations and maximize any potential refunds. Don’t forget to double-check your entries before submitting!

Who Needs to File Form 1040

Who needs to file Form 1040? If you’re a U.S. citizen or resident alien with income, you generally must file. This includes wages, self-employment earnings, interest, dividends, and capital gains.

Even if your income falls below the filing threshold, you might want to file to claim refunds or tax credits. If you’re 65 or older, you can use the 1040 SR form, which simplifies the filing process. This form is designed for seniors, allowing a more straightforward approach to report income and deductions.

Additionally, if you’d health coverage through the Marketplace or owe taxes on unreported income, you’ll need to file Form 1040. Make sure to check the IRS guidelines for specific requirements based on your situation.

Key Components of Form 1040

Form 1040 serves as the foundation for your annual income tax return, detailing your income, deductions, and tax liabilities.

You’ll find several key components on this form. First, you’ll report your filing status, which affects your tax rate. Next, list your income sources, including wages, interest, and dividends. After that, you’ll move on to adjustments, which can lower your taxable income. In the deductions section, you can either take the standard deduction or list itemized deductions. Your tax liability is calculated based on your taxable income.

Finally, you’ll report any payments or credits to determine if you owe taxes or if you’ll receive a refund. Understanding these components makes filing your taxes smoother and more accurate.

Common Deductions and Credits

Understanding common deductions and credits can significantly reduce your taxable income, ultimately increasing your refund or lowering your tax bill.

You can claim deductions for mortgage interest, student loan interest, and medical expenses, among others. If you’re a parent, don’t forget about the Child Tax Credit or the Earned Income Tax Credit, which can provide substantial savings. Contributions to retirement accounts like IRAs also offer potential deductions. Keep track of any charitable donations, as they may be deductible too.

Additionally, if you’re self-employed, business expenses like home office costs can reduce your taxable income.

Filing Process and Deadlines

When it comes to filing your taxes, knowing the important deadlines can save you from unnecessary penalties and stress.

You’ll typically need to submit Form 1040 by April 15th. If you can’t meet this deadline, file for an extension, giving you until October 15th to complete your return. However, remember that an extension only applies to filing, not the payment of taxes owed. Make sure to pay any estimated taxes by the quarterly deadlines—April 15, June 15, September 15, and January 15 of the following year.

Keep track of these dates to avoid late fees and interest. Always double-check the IRS website for any changes or updates to deadlines that may affect you.

Conclusion

In conclusion, understanding IRS Form 1040 is essential for meeting your tax obligations. Whether you’re a first-time filer or just need a refresher, knowing who needs to file and what components to include can make the process smoother. Don’t forget to explore the deductions and credits available to you, as they can significantly reduce your tax liability. Stay on top of deadlines, and you’ll navigate your tax filing with confidence and ease.